Wednesday May 26 2021 09:42

2 min

Snowflake (SNOW) is due to report its first quarter results after the close today (May 26th). Shares in the company are worth about a half of the value they were at their peak in 2020.

The consensus estimate for Q1 is $213.36m in revenue and a $0.16 loss per share. In Q4, Snowflake posted a loss per share of $0.70 on a 117% rise in revenues of $190.5 million.

Goldman Sachs put out a note yesterday on the stock, giving it a buy rating with a 12-month price target of $275. “Following a ~40% correction in the stock since its December 2020 highs, we see a path towards outperformance and believe the durability of growth is not fully reflected in the company’s valuation,” they said.

Snowflake is seen as being well-positioned to capitalize on a “generational shift” in data and analytics to the cloud, and replace incumbent data warehousing solutions “owing to their scalable and elastic cloud native”. GS added: “We continue to expect another strong quarter as the overall demand environment remains resilient.”

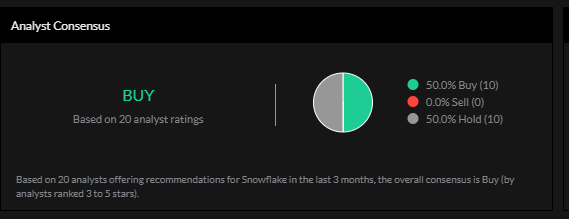

Analysts maintain a broadly positive stance on the stock, with 50/50 buy/hold ratings.

Price action has been positive of late although we have seen the momentum just fade a little as it approached the April swing highs around $244. The beak of the trendline from the Dec ‘20, Feb ‘21 and Apr ‘21 peaks suggests bulls are taking charge again. MACD crossover also seen as bullish.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.

Asset List

View Full ListLatest

View allThursday, 4 September 2025

3 min

Thursday, 4 September 2025

5 min

Thursday, 4 September 2025

3 min

Thursday, 4 September 2025

Indices

UK Gilts: A Generational Buying Opportunity? Analyzing the Bond Market Surge

Thursday, 4 September 2025

Indices

Optimus Next Gen: A Glimpse at Tesla's New Gold Robot and Musk's Future Vision