Thursday Nov 4 2021 12:33

5 min

“Oh, the grand old Duke of York

He had ten thousand men

He marched them up to the top of the hill

And he marched them down again”

There’s been a lot of talk about loose shopping trolleys in Westminster today amid the government’s U-turn on MPs’ standards. (I didn’t know they had any?). But we need to look only to Andrew Bailey for our grand old Duke of York, happily marching markets up the hill to expect a rate hike today only to need to march them back down again.

The Bank of England delivered a surprise by not raising rates, sending gilts and sterling into a bit of a spin. It’s really one of those moments where you have to question the communication strategy of the BoE. It had multiple occasions on which it could have gently nudged against the growing market anticipation around the November meeting being live but chose not to, and appeared to actively encourage tightening bets. Credibility is at stake, Mr Bailey. I’d said a hike was no slam dunk due to the way certain MPC members were leaning, but Bailey has been cheerleading tighter policy and didn’t vote for it himself – which suggests either he’s bad at communicating his views or there were simply not enough votes for him so he refrained from being a minority voter.

Members of the MPC voted 7-2 to keep rates at 0.1%, a move that the market had not anticipated. Recent chuntering from the members had suggested a hike was incoming but it looks like the Hawks didn’t have the votes this time – 7/2 maybe belies just how close they were to hiking today though. Dave Ramsden and Michael Saunders were the two known hawks calling for a hike, but none of the others followed in their wake. Although Catherine Mann did join those two in voting for an end to QE.

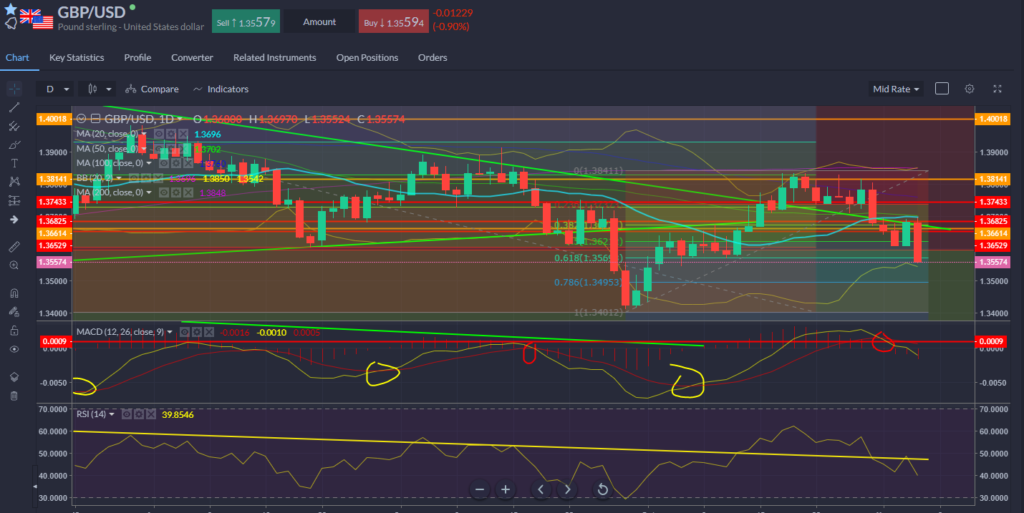

Market reaction has been swift with sterling offered off the back of the announcement. GBPUSD moved rapidly to test the 61.8% level we’d targeted at the start of the week. The FTSE 100 popped higher on the news with lower sterling and looser monetary policy seen as positive for risk.

The Bank of England is sticking to the transitory line on inflation…

“CPI inflation is expected to dissipate over time, as supply disruption eases, global demand rebalances, and energy prices stop rising. As a result, CPI inflation is projected to fall back materially from the second half of next year.”

And thinks expectations are not off the leash – despite year-ahead expectations rising to 4.4% in October. A slight fall in 5- and 10-year expectations was cited as a reason to be calm.

“The MPC judged that inflation expectations remained well anchored in the United Kingdom at present.”

Caution around employment just enough to warrant dovishness, it would appear.

“Initial indicators suggest that unemployment will rise slightly in 2021 Q4.”

But tightening is still seen ahead – the question for markets is when?

“The Committee has judged that some modest tightening of monetary policy over the forecast period was likely to be necessary to meet the 2% inflation target sustainably in the medium term.”

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.