Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Tuesday Dec 16 2025 09:51

25 min

Best CFD Trading Platform for 2026: CFD trading has gained significant popularity among retail investors seeking to profit from price movements in various financial instruments without owning the underlying assets.

Start investing in 2026: As we approach 2026, the landscape of CFD trading platforms is expected to evolve, influenced by technological advancements, regulatory changes, and shifting market dynamics. This article will guide you through essential factors to consider when choosing a CFD trading platform, ensuring that you select a broker that aligns with your trading needs and preferences.

Understanding Regulatory Oversight

When engaging in CFD trading, the first and foremost consideration should be the supervision and regulation of the trading platform. Regulatory oversight is crucial as it ensures that brokers adhere to transparent practices and maintain a certain level of operational integrity.

Key Regulatory Bodies

Different regions have varying regulatory frameworks governing financial trading. Some of the most reputable regulatory bodies include:

Importance of Regulatory Compliance

Choosing a broker regulated by a reputable authority enhances your trading experience significantly. Regulatory oversight protects traders by ensuring fair trading conditions, segregated accounts, and adequate dispute resolution mechanisms.

Before selecting a CFD platform, verify its regulatory status. Check the broker’s website or contact customer service for this information. A broker’s license should be prominently displayed; if it’s not, be cautious and consider other options.

Additional Licensing and Review

In addition to regulatory compliance, consider any additional licenses held by the broker. For example, obtaining multiple licenses from different jurisdictions often indicates a commitment to adhere to rigorous standards. Reading reviews and testimonials can also provide insights into the broker’s reputation and reliability.

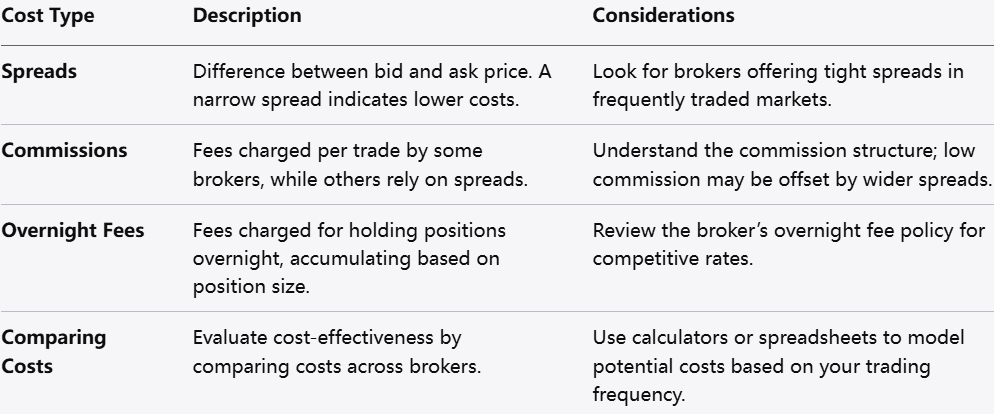

Understanding Fees and Spreads

Trading costs can significantly impact your profitability in CFD trading. It is essential to understand the various costs involved, which typically include spreads, commissions, and overnight financing fees.

Spreads

The spread is the difference between the bid and ask price of an asset. A narrow spread is typically preferable, indicating lower trading costs. Look for brokers that offer tight spreads, especially in the markets you intend to trade frequently.

Commissions

Some brokers charge a commission on trades, while others rely solely on spreads for their revenue. Understanding the commission structure is essential in evaluating overall trading costs. Low-commission brokers may seem appealing, but if spreads are wide, you may end up paying more in costs.

Overnight Fees

Overnight financing fees are charged when positions are held overnight and can accumulate quickly, depending on the size of your position and the duration of the hold. Be sure to read the broker’s policy on overnight fees and whether they provide a competitive edge in terms of rates.

Comparing Costs

To evaluate the cost-effectiveness of different CFD trading platforms, take the time to compare their trading costs against each other. Utilize calculators or spreadsheets to model potential trading costs over a set period based on your trading frequency and strategy. This analysis will help you make an informed decision.

Importance of Speed in Trading

Order execution speed is critical in the fast-paced world of CFD trading. High volatility can lead to rapid price movements, and delays in order execution can result in substantial losses or missed opportunities.

Factors Affecting Execution Speed

Evaluating Execution Performance

When considering a trading platform, seek out performance metrics that demonstrate execution speed and reliability. Many platforms publish information regarding their average execution times and statistics on slippage or order rejections.

You can also conduct a personal test. Open a demo account and execute trades to gauge how quickly orders are filled. If execution speeds are slow or inconsistent, it may be a significant drawback to that platform.

Importance of User Experience

A user-friendly trading platform is vital, especially for new traders. An intuitive interface can enhance your trading experience and reduce the learning curve associated with advanced trading tools and features.

Key Features to Consider

Customization Options

Consider the customization options available on the trading platform. The ability to tailor charts, indicators, and other features to suit your preferences can greatly enhance your experience. A platform that allows traders to create personalized layouts can help streamline the trading process.

Range of Financial Instruments

When selecting a CFD trading platform, examine the range of products available for trading. A diverse product offering allows you to diversify your trading strategies and portfolio.

Key Instruments to Look For

Understanding Leverage

Leverage is a powerful tool in CFD trading, allowing you to control a larger position with a smaller amount of capital. However, it also amplifies your risk, so understanding leverage limits is essential.

Factors to Consider Regarding Leverage

Leverage Ratios: Different brokers offer varying leverage ratios. While high leverage can enhance potential returns, it also increases risk. Evaluate how much leverage aligns with your trading strategy and risk tolerance.

Regulatory Restrictions: Some regulatory bodies impose restrictions on leverage levels offered to retail traders. Be aware of these limitations as they may vary by region or regulatory oversight.

Balancing Risk and Reward

Ultimately, while leverage can lead to larger potential profits, it can also expose you to significant risks. Consider your risk management strategies, such as stop-loss orders or margin calls, to protect your capital. Understanding the products being traded, combined with an appropriate leverage strategy, can enhance your overall trading experience.

Importance of Reliable Customer Support

Efficient customer service from your CFD broker can make a difference, especially in times of crisis or confusion. A broker that prioritizes customer satisfaction often enhances the trading experience.

Key Elements of Customer Support

Availability: Check if the broker offers customer support during market hours and beyond. 24/7 customer support can be advantageous, especially for those trading outside standard business hours.

Communication Channels: Evaluate the support channels available, such as live chat, email, phone support, and social media. Effective communication options facilitate quicker resolutions.

Multilingual Support: If you are not a native English speaker, ensure the broker provides customer support in multiple languages to facilitate effective communication.

Responsiveness and Quality

Test the responsiveness of the customer support team by reaching out with questions before opening an account. Note their response time and the quality of the answers provided. A knowledgeable, responsive support team can significantly enhance your trading experience.

Selecting the best CFD trading platform for 2026 requires careful consideration of multiple factors, including regulatory supervision, trading costs, execution speed, user-friendliness, available products, leverage options, and customer service. As the financial landscape evolves, it is essential to choose a broker that aligns with your trading style and offers the tools and resources necessary for success.

Investing the time to research and evaluate potential brokers while considering these critical factors can significantly enhance your trading experience. As always, ensure that you continue to educate yourself about the markets and trading strategies, enabling you to make informed decisions in an ever-changing environment.

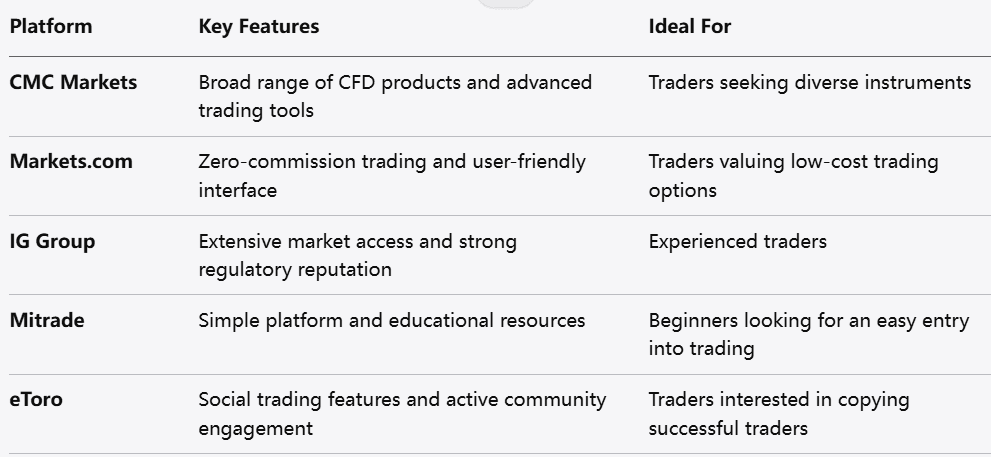

As the CFD trading landscape evolves, traders are increasingly seeking platforms that offer robust features, reliability, and diverse market access. Choosing the right broker is essential for success in this dynamic environment. Here, we explore five of the best CFD trading platforms for 2026: CMC Markets, Markets.com, IG Group, Mitrade, and eToro. Each platform has its unique strengths and offerings, making them suitable for various trading styles and preferences.

CMC Markets

Overview

Founded in 1989, CMC Markets is a well-established player in the CFD trading space. The platform is known for its comprehensive range of financial products, including forex, commodities, indices, and shares, accompanied by competitive pricing and advanced trading tools.

Strengths

Wide Product Range: CMC Markets offers an extensive selection of over 10,000 CFDs across multiple asset classes, providing traders with diverse opportunities. From forex pairs to global indices, commodities, and individual stocks, there’s ample choice for various trading strategies.

Competitive Spreads: The platform features competitive spreads, particularly in popular markets. This cost-efficiency is vital for traders looking to maximize their profitability.

User-Friendly Interface: CMC Markets utilizes a well-designed trading platform with an intuitive interface. The platform is suitable for both beginners and experienced traders, featuring easy navigation and customizable dashboards.

Advanced Trading Tools: The platform excels in providing a suite of advanced trading tools, including technical analysis, charting software, and market indicators. These tools empower traders to make informed decisions based on real-time data.

Regulatory Compliance: CMC Markets is regulated by several authorities, including the FCA and ASIC, ensuring a high level of security and trustworthiness. Regulatory compliance is crucial for protecting traders’ interests and funds.

Weaknesses

Limited Cryptocurrency Offering: While CMC Markets provides a diverse selection of financial instruments, its cryptocurrency options are relatively limited compared to some competitors. Traders focused solely on digital assets may find this aspect lacking.

No Hexadecimal Accounts: For traders seeking accounts with different hedging options, CMC Markets may not cater to these specialized needs, as it primarily offers standard accounts.

CMC Markets stands out as a solid choice for CFD traders in 2026 due to its diverse product offering, competitive pricing, and robust trading tools. Its reputation for regulatory compliance further strengthens its position as a reliable broker. However, traders with a keen interest in cryptocurrencies may want to explore additional options.

Markets.com

Overview

Markets.com is a global trading platform that caters to both retail and institutional investors. Launched in 2008, it has quickly gained popularity for its user-friendly interface and comprehensive range of trading products.

Markets.com shines for its zero-commission trading and user-friendly interface, making it an appealing choice for both new and experienced traders. Its broad asset selection and strong customer support add further value. However, advanced traders may want more sophisticated features that some other platforms provide.

IG Group

Overview

IG Group, founded in 1974, is one of the oldest CFD providers in the world. The platform is highly regarded for its innovative technology, wide range of products, and strong regulatory reputation.

Strengths

Wide Range of Markets: IG Group offers access to over 17,000 markets, including forex, shares, commodities, indices, and cryptocurrencies. This extensive offering allows traders to pursue various strategies across different asset classes.

Advanced Trading Platform: The IG trading platform is equipped with advanced charting tools, technical indicators, and customizable workspaces. Traders can conduct thorough analyses and tailor their trading environment to suit their preferences.

Regulatory Reputation: As a publicly traded company regulated by the FCA, ASIC, and other authorities, IG Group is known for its transparency and high level of investor protection.

Multiple Account Types: IG offers various account types to cater to different trading needs, including spread betting and options trading alongside standard CFD accounts.

Educational Material: The platform provides extensive educational resources, including webinars and trading guides, enabling traders to enhance their trading skills continuously.

Weaknesses

Higher Spreads on Some Instruments: While IG Group offers many benefits, some instruments may have wider spreads compared to other brokers, potentially affecting profitability, especially for high-frequency traders.

Complex Fee Structure: The fee structure may be more complex than that of other brokers, which can be overwhelming for some users to navigate.

IG Group is an excellent choice for traders looking for a reputable broker with a wide range of markets and advanced trading tools. Its long-standing presence in the industry and regulatory reputation enhance its credibility. Although it may have slightly higher spreads on some instruments, the extensive features and educational resources make it a worthwhile option for many traders.

Mitrade

Overview

Mitrade is a relatively new player in the CFD trading market, established in recent years. It has quickly gained traction due to its focus on providing a simplified trading experience for retail investors.

Strengths

User-Friendly Platform: Mitrade's trading platform is designed to be intuitive, making it accessible for beginners. The simple layout allows for easy navigation, efficient order execution, and a smooth trading experience.

Competitive Spreads: Mitrade offers competitive spreads on various instruments, allowing traders to minimize trading costs effectively.

Wide Range of Assets: The platform provides access to multiple asset classes, including forex, commodities, indices, and cryptocurrencies, giving traders a diverse range of trading opportunities.

Educational Resources: Mitrade emphasizes customer education, offering a variety of resources such as tutorials, webinars, and articles designed to improve traders’ understanding of the markets.

Regulatory Compliance: Mitrade is regulated by reputable authorities, ensuring a level of security and trust for its traders.

Weaknesses

Limited Advanced Features: Being relatively new, Mitrade may lack some of the advanced trading features and tools found on longer-established platforms, which could deter more experienced traders.

Smaller Brand Recognition: Compared to more established brokers, Mitrade might not have the same level of brand recognition, which could raise concerns for some traders.

Mitrade provides a user-friendly trading environment suitable for beginners, with competitive spreads and a good selection of assets. While it may lack some advanced features and brand recognition, its focus on education and regulatory compliance makes it a solid option for retail traders.

eToro

Overview

eToro is a leading social trading platform that has revolutionized how people engage with financial markets. Established in 2007, eToro is known for its innovative approach to trading, particularly through its social and copy trading features.

Strengths

Social Trading Features: eToro's standout feature is its social trading capabilities, allowing users to copy the trades of experienced investors. This feature is particularly beneficial for novice traders looking to learn from successful traders.

Extensive Market Access: eToro offers a variety of assets, including stocks, cryptocurrencies, commodities, and forex. This diverse offering allows traders to explore different markets and incorporate various strategies.

User-Friendly Interface: eToro's platform is designed with ease of use in mind, making it accessible for traders of all skill levels. The straightforward layout and features encourage users to engage with the platform confidently.

Active Community: eToro boasts a large and engaged trading community, enabling users to interact, share strategies, and gather insights. This community aspect adds a social dimension to the trading experience.

Regulatory Compliance: eToro is regulated in multiple jurisdictions, including the FCA and CySEC, providing traders with a level of security and trust in the platform’s operations.

Weaknesses

Higher Spreads on Some Assets: While eToro offers unique trading features, some traders may find the spreads higher on certain assets compared to other brokers, which can affect profitability.

Limited Advanced Trading Tools: eToro may not provide as many advanced trading tools and analytics features as some traditional brokers, which could be a drawback for experienced traders seeking in-depth analysis.

eToro is an excellent platform for those interested in social trading and looking to leverage the expertise of others in the market. Its user-friendly interface and extensive asset selection make it appealing to both novice and experienced traders. Despite slightly higher spreads and fewer advanced tools, the unique social features often outweigh these concerns for many users.

Conclusion: Choosing the Right CFD Trading Platform

Selecting the best CFD trading platform for 2026 involves evaluating individual needs, trading strategies, and preferences. Each of the platforms discussed—CMC Markets, Markets.com, IG Group, Mitrade, and eToro—has its unique strengths and weaknesses.

CMC Markets is ideal for traders seeking a broad range of CFD products and advanced trading tools.

Markets.com appeals to those who value zero-commission trading and user-friendly interfaces.

IG Group offers a wealth of markets and a solid regulatory reputation, making it suitable for experienced traders.

Mitrade provides simplicity and educational resources, perfect for beginners.

eToro caters to traders interested in social trading and community engagement.

Ultimately, the choice of a CFD trading platform will depend on individual trading goals, experience levels, and specific preferences. By carefully considering the features, costs, and offers of each platform, traders can position themselves for success in the evolving CFD landscape.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.