Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Dec 12 2025 09:09

24 min

A Complete Guide to Cryptos: As digital currencies gain traction across the globe, many individuals are exploring how to navigate this exciting landscape.

Start investing in 2026: for beginners, understanding the fundamental nature of cryptocurrencies, their operational mechanisms, the benefits and risks associated with investing, and whether it's a suitable addition to their portfolios is essential. This guide aims to provide valuable insights into these questions and empower those looking to invest in cryptocurrencies as we progress through 2026.

Cryptocurrency is a type of digital or virtual currency that employs cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized platforms, primarily based on a technology called blockchain.

At its core, blockchain technology serves as a public ledger that records all transactions across a network of computers. This decentralized nature ensures that no single entity has control over the entire network, which contributes to the security and transparency that cryptocurrencies offer.

Each transaction is grouped into blocks, which are then linked together in a chronological sequence. Once a block is added to the chain, altering any information contained within it is nearly impossible without modifying all subsequent blocks, an endeavor that would require immense computational power. This immutability is a key feature of blockchain that enhances trust among users.

While Bitcoin was the first cryptocurrency created in 2009, the market has since exploded with thousands of other cryptocurrencies. Here are a few examples:

These diverse cryptocurrencies cater to different use cases, showcasing the flexibility and potential of blockchain technology.

Understanding the workings of cryptocurrencies involves grasping several components, including mining, wallets, and transactions.

Mining

Mining refers to the process by which transactions are validated and added to the blockchain. In the case of Bitcoin, miners use computational power to solve complex mathematical problems that validate transactions. In return for their efforts, miners are rewarded with newly minted coins and transaction fees.

This process ensures that a significant amount of computational work is required to manipulate transactions, providing security to the network. However, not all cryptocurrencies utilize mining. Some, like Ethereum, are transitioning to a proof-of-stake consensus mechanism, which requires validators to lock up a portion of their cryptocurrency as collateral.

Cryptocurrency Wallets

A cryptocurrency wallet is essential for anyone looking to invest in or use cryptocurrencies. It holds the private and public keys necessary to send and receive coins.

There are different types of wallets:

Transactions

When you want to send cryptocurrency to someone, the transaction goes through a series of steps:

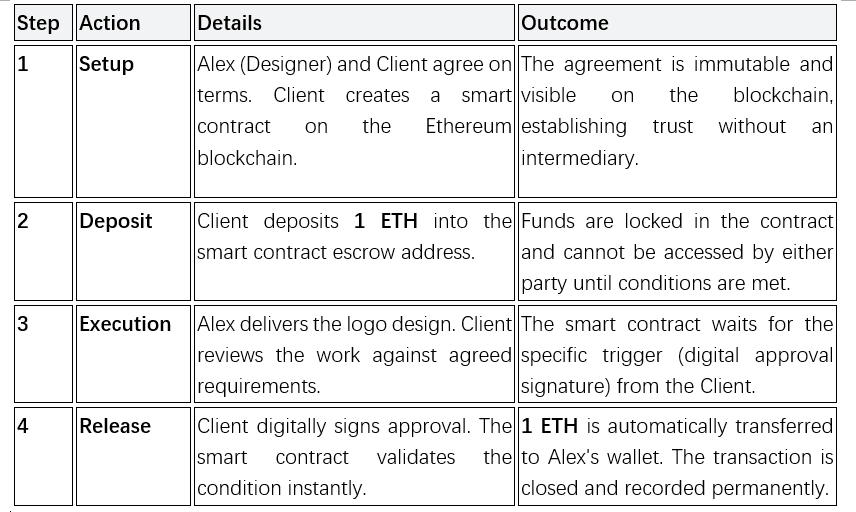

Smart Contracts

One of the unique features of certain cryptocurrencies, particularly Ethereum, is the capability to create smart contracts. These self-executing contracts automate agreements and transactions without intermediaries.

For example, a smart contract can automatically execute a payment once certain conditions are met. This technology expands the potential use cases for cryptocurrencies beyond simple transactions, enabling applications ranging from finance to real estate.

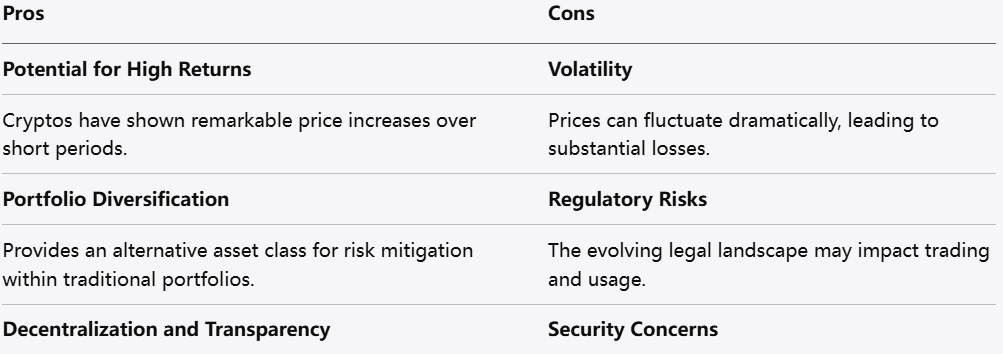

Investing in cryptocurrencies comes with its own set of advantages and disadvantages. Understanding these can help beginners make informed decisions.

Pros

Potential for High Returns: Cryptos have shown remarkable price increases over relatively short periods. Early adopters of Bitcoin and Ethereum, for instance, have seen substantial gains.

Portfolio Diversification: Cryptocurrencies can serve as an alternative asset class, providing diversification to a traditional investment portfolio that often includes stocks and bonds. This may help mitigate risk in overall investment strategies.

Decentralization and Transparency: The decentralized nature of blockchain minimizes the influence of a single authority, providing greater transparency. This appeals to those who prioritize autonomy and privacy.

Innovation and Future Potential: The cryptocurrency market is at the forefront of technological innovation. Investing in this space opens the door to being part of groundbreaking developments in finance and technology.

Access to Global Markets: Cryptocurrencies can be traded globally without the constraints of traditional banking hours, allowing for greater liquidity.

Cons

Volatility: Cryptocurrency markets are notoriously volatile. Prices can fluctuate dramatically within short time frames, which can lead to substantial losses.

Regulatory Risks: The legal landscape surrounding cryptocurrencies is still evolving. Changing regulations may impact how cryptocurrencies are traded and used, leading to uncertainty for those invested in this space.

Security Concerns: While blockchain itself is secure, the platforms and exchanges where cryptocurrencies are traded may be vulnerable to hacks and frauds. Ensuring proper security practices is essential.

Lack of Consumer Protections: Unlike traditional banking systems, cryptocurrencies often lack consumer protection measures. In cases of lost private keys or fraudulent transactions, recovery options may be limited.

Complexity: For beginners, the cryptocurrency landscape can be overwhelming. The need to understand blockchains, wallets, and various cryptocurrencies adds layers of complexity that may deter some potential investors.

Determining whether cryptocurrency is a suitable investment involves personal circumstances, risk tolerance, and investment goals. Here are several considerations for beginners contemplating entry into the cryptocurrency market:

Risk Tolerance

Understanding your own comfort level with risk is vital. The high volatility associated with cryptocurrencies means you should only invest what you can afford to lose. A well-balanced financial plan should account for both high-risk and low-risk investments.

Research and Education

Those new to cryptocurrency should spend time learning about the various options available. Researching specific cryptocurrencies, their use cases, and the technology behind them can help build a solid foundation for informed investments. Engaging with credible sources of information, such as books, reputable financial news websites, and online courses, can enhance understanding.

Long-Term vs. Short-Term

Investing strategies vary between short-term trading and long-term holding (known as HODLing). Short-term trading may involve frequent buying and selling based on market fluctuations, while long-term investing focuses on the potential growth of a cryptocurrency over several years. Each approach requires different levels of market knowledge and time commitment, and choosing one depends on your investment goals.

Diversification

As with any investment strategy, diversification is key. Holding a variety of cryptocurrencies can mitigate risks associated with individual assets. Allocating small portions of your portfolio to multiple cryptocurrencies may allow you to benefit from different market movements.

Regulatory Landscape

Staying informed about the evolving legal frameworks surrounding cryptocurrencies is crucial. Changes in regulations can have significant implications for how cryptocurrencies operate and are valued. Understanding the risks associated with potential regulatory shifts can shape your investment approach.

Psychological Factors

The psychology of investing plays a substantial role when it comes to cryptocurrencies. Fear and greed can lead investors to make impulsive decisions. Maintaining a clear strategy and resisting emotional reactions to market fluctuations is essential for sustained engagement in the market.

Market Trends

Observing trends within the cryptocurrency market can provide valuable insights into future movements. While it’s important to base decisions on research rather than speculation, understanding broader market sentiments can guide your investments.

As cryptocurrencies continue to shape the future of finance, new trading mechanisms have emerged, allowing individuals to engage with digital assets in diverse ways. One such method is trading cryptocurrency Contracts for Difference (CFDs).

A cryptocurrency CFD is a financial derivative that allows traders to speculate on the price movements of cryptocurrencies without actually owning the underlying assets. Instead of buying and holding cryptocurrencies directly, CFDs enable participants to enter contracts with a broker to exchange the difference in the value of a cryptocurrency between the time the contract is opened and closed.

Leverage: One of the most significant advantages of trading CFDs is the ability to use leverage. This means traders can control larger positions than their initial investment. While this can amplify potential returns, it also increases risk.

Short Selling: CFDs allow traders to take short positions. If you believe the price of a cryptocurrency will decline, you can sell a CFD to profit from the downward movement.

No Ownership: Since CFDs do not involve the actual purchase of cryptocurrencies, there are no concerns regarding wallet management, security, or other issues related to direct ownership.

Flexibility: CFDs can be traded 24/7, which aligns well with the crypto market's continuous operation. This flexibility allows traders to react to market changes at any time.

Diverse Options: Many platforms offer a range of cryptocurrencies for CFD trading, allowing traders to diversify their portfolios and explore various digital assets.

Understanding how cryptocurrency CFD trading operates is crucial for beginners looking to engage with this market effectively.

Opening a CFD Position

Choose Your Broker: To trade cryptocurrency CFDs, you must choose a reputable broker that offers this service. Consider aspects like fees, customer service, and the selection of cryptocurrencies available.

Create an Account: Once you’ve selected a broker, you will need to create an account. This typically involves providing personal information and completing identity verification processes.

Deposit Funds: After your account is set up, you'll deposit funds to begin trading. Different brokers have varying minimum deposit requirements.

Select a Cryptocurrency: Choose the cryptocurrency you wish to trade. Many brokers provide access to popular options such as Bitcoin, Ethereum, and others, along with detailed information about each asset.

Set Up Your Trade: You can choose to place a buy (long) or sell (short) order depending on your market sentiment. Determine your position size, stop-loss levels, and take-profit targets to set your risk parameters.

Executing Your Trade

Once your trade parameters are defined, executing the trade is straightforward:

Market Order: This type of order allows you to open a position at the current market price. It’s the fastest way to enter a trade.

Limit Order: Setting a limit order lets you specify the price at which you want to enter the trade. This can be beneficial if you are looking to capitalize on price retracements.

After executing your trade, the position will be open, and you will begin to gain or lose money based on the cryptocurrency’s price movements.

Closing a CFD Position

When you decide to close a CFD position, the broker will calculate the difference between the entry price and the exit price:

If the price increased: If you opened a buy position and the value of the cryptocurrency has risen, the difference will be credited to your account.

If the price decreased: Conversely, if the price has fallen and you opened a buy position, the difference will be deducted from your account balance.

Costs and Fees

When trading cryptocurrency CFDs, be aware of the costs involved, including:

Engaging in cryptocurrency CFD trading without robust risk management is risky. Here are some effective strategies for beginners:

1. Set a Trading Plan

Before entering any trade, develop a comprehensive trading plan. Include your goals, risk tolerance, and strategies for different market scenarios. This structured approach can help guide decision-making during volatile periods.

2. Use Stop-Loss Orders

A stop-loss order automatically closes a position when the price reaches a specified level, limiting potential losses. Setting appropriate stop-loss levels can significantly reduce risk exposure.

3. Control Position Sizes

Avoid over-leveraging your trades. A common guideline is to risk no more than one to two percent of your trading capital on a single trade. By controlling your position size, you mitigate the impact of a loss on your overall account balance.

4. Diversify Your Trades

Engaging in various cryptocurrency CFDs can help spread risk across different assets. If one cryptocurrency underperforms, gains in others may offset losses.

5. Stay Informed

Constantly monitor market news and developments affecting cryptocurrencies. Being aware of external factors such as regulations, technological advancements, and market sentiment can provide critical insights for your trading strategy.

6. Maintain Emotional Discipline

Emotional trading often leads to poor decisions. Stick to your trading plan and remain disciplined. Avoid making impulsive trades based on fear or greed, and practice patience to allow trades to develop naturally.

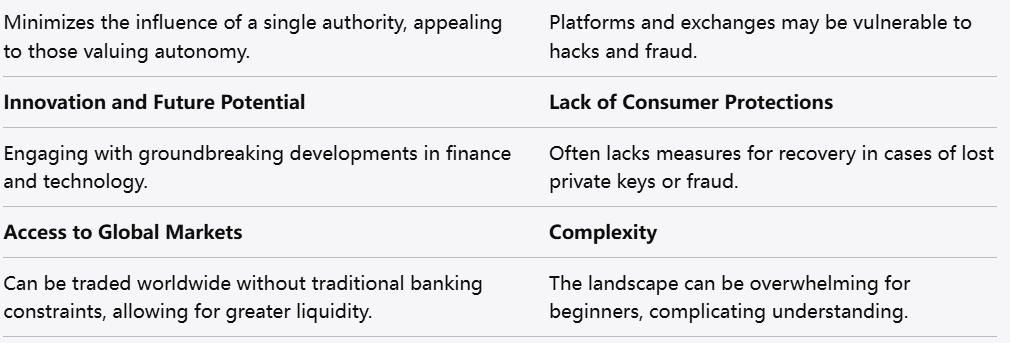

When selecting a platform for cryptocurrency CFD trading, several factors contribute to overall suitability. Markets.com is often considered an excellent choice for various reasons:

1. User-Friendly Interface

Markets.com offers an intuitive trading platform that caters to beginners. The user-friendly interface simplifies the trading process, making it accessible for newcomers while still offering advanced features for experienced traders.

2. Wide Range of Cryptocurrencies

The platform hosts a diverse selection of cryptocurrencies for CFD trading, allowing users to explore various assets and trends. This variety enables traders to diversify their portfolios easily.

3. Educational Resources

Markets.com provides educational resources to help traders improve their skills. From webinars to articles and video tutorials, these materials empower beginners to learn about trading strategies, market analysis, and risk management.

4. Competitive Spreads and Fees

The platform often offers competitive spreads, which can enhance trading profitability. Additionally, a transparent fee structure ensures that traders are aware of any costs associated with their activities.

5. Strong Regulatory Framework

Markets.com operates under strict regulatory standards, providing traders with confidence in the safety of their funds and the integrity of the trading environment.

6. Excellent Customer Support

The platform offers responsive customer support, assisting beginners with any inquiries or issues they may encounter while trading. Access to knowledgeable support staff can be invaluable in navigating the complexities of crypto trading.

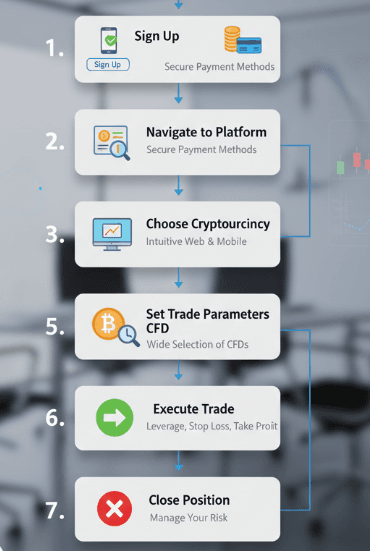

Trading cryptocurrency CFDs on Markets.com involves a straightforward process. Here's a step-by-step guide:

Step 1: Sign Up

Visit the Markets.com website and click on the “Sign Up” button. Fill out the necessary information to create your account, and complete any verification requirements.

Step 2: Deposit Funds

After your account is activated, navigate to the deposit section. Markets.com typically offers various funding methods, including credit/debit cards, bank transfers, and e-wallets. Deposit sufficient funds to start trading.

Step 3: Navigate to the Trading Platform

Once your account is funded, log into the trading platform. Familiarize yourself with the interface, exploring different features and tools that will aid your trading.

Step 4: Choose a Cryptocurrency CFD

Select the cryptocurrency you wish to trade. The platform will provide relevant data, including charts, prices, and historical performance, which can assist with informed decision-making.

Step 5: Set Your Trade Parameters

Define your trade parameters, such as position size, stop-loss, and take-profit levels. Ensure that your trading plan aligns with your risk management strategies.

Step 6: Execute Your Trade

Choose whether to go long (buy) or short (sell) based on market sentiment. Once everything is in place, execute the trade. Monitor your position regularly to stay informed about market movements.

Step 7: Closing Your Position

When you decide to close your position, follow the appropriate steps on the platform. Review your final results and learn from each trade to refine your future strategies.

1. What are the benefits of trading cryptocurrency CFDs?

Trading cryptocurrency CFDs allows you to speculate on price movements without owning the underlying asset. You can utilize leverage, short-sell, and access a variety of cryptocurrencies while trading around the clock.

2. Is CFD trading risky?

Yes, CFD trading carries a high level of risk, particularly due to volatility and leverage. It is essential to understand these risks fully and implement risk management strategies.

3. Can I lose more than my initial investment?

Yes, due to leverage, it is possible to lose more than your initial investment. That is why controlling your position size and using stop-loss orders are critical.

4. What is the minimum deposit required to start trading on markets.com?

Minimum deposit requirements can vary by account type. Check the Markets.com website for the most current information regarding minimum deposit limits.

5. Are there any commissions or fees associated with trading crypto CFDs?

Markets.com typically charges spreads on trades, and other fees may apply depending on market conditions and account types. Always review the fee structure before trading.

6. How can I improve my trading skills?

Engaging with educational resources provided by Markets.com, practicing with a demo account, and staying informed about market trends can help you enhance your trading skills.

7. What cryptocurrencies can I trade as CFDs?

Most platforms, including markets.com, offer a wide range of cryptocurrencies for CFD trading. Popular options often include Bitcoin, Ethereum, Litecoin, Ripple, and more. Check the specific platform for a complete list of available cryptocurrencies.

8. How does leverage work in cryptocurrency CFD trading?

Leverage allows traders to control a larger position than their actual capital. For example, if a broker offers 10:1 leverage, you can potentially trade up to ten times your initial deposit. However, while leverage can amplify profits, it also magnifies losses, making risk management essential.

9. Can I trade cryptocurrency CFDs on mobile devices?

Yes, many brokers, including markets.com, provide mobile applications that enable traders to manage their positions on the go. Mobile trading offers flexibility and allows you to access the market anytime and anywhere, provided you have an internet connection.

10. What should I do if I experience issues with a trade?

If you encounter problems during a trade, such as execution errors or technical glitches, reach out to the customer support team of your trading platform immediately. Most reputable brokers have responsive customer service to assist with troubleshooting and ensure your trading experience is seamless.

Cryptocurrency presents a unique and evolving investment landscape for beginners in 2026. As digital currencies become increasingly integrated into the global financial system, the opportunity to engage with this innovative sector is more accessible than ever. Understanding the nature of cryptocurrency, how it functions, the inherent advantages and disadvantages, and individual risk tolerance will empower potential investors to make informed decisions.

While the world of cryptocurrency can be complex, thorough research, patience, and a strategic approach can open doors to new financial avenues. As with any investment, a balanced perspective will serve to navigate the inevitable challenges and rewards that lie ahead in this dynamic market.

As cryptocurrency CFDs become increasingly popular, understanding how to navigate this trading method is essential for beginners. By grasping the fundamentals of crypto CFDs, employing effective risk management strategies, and selecting a reliable trading platform like Markets.com, aspiring traders can position themselves to participate safely and effectively in the exciting world of cryptocurrency trading in 2026. Armed with knowledge and preparation, newcomers can engage with the markets confidently, exploring the myriad potentials that cryptocurrencies offer.

Looking to trade crypto CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.