Monday Oct 20 2025 10:12

8 min

What is gold trading: The concept of a single "best" placement for gold is dependent on an individual's financial goals, duration perspective, and approach to risk.

Given the metal's diverse forms—ranging from physical bars to sophisticated derivative agreements—the most suitable vehicle varies widely based on whether one seeks direct ownership, exposure to market movements, or a way to balance a broader collection of assets. No single method is universally superior; each requires a clear understanding of its distinct characteristics and associated risk profile.

What is Gold Trading?

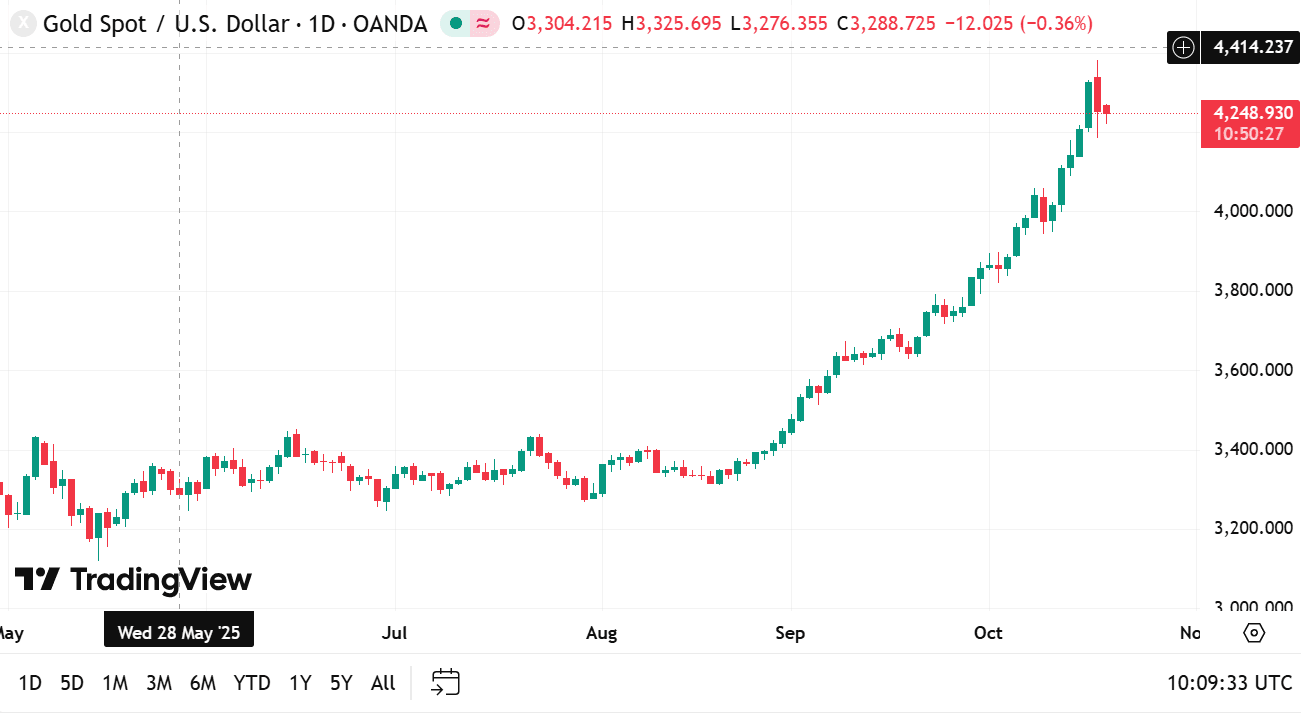

source: traidngview

Gold trading is the act of exchanging the precious metal within a commercial setting. It encompasses the buying and selling of gold or related financial instruments with the intention of capitalizing on the metal’s fluctuating market quotation. This activity is fundamentally a form of speculation, where participants attempt to anticipate whether the quotation of the commodity will rise or fall over a given period. Unlike merely holding the physical asset for its intrinsic value, dealing involves actively managing a position based on expectations of future market shifts. This can be executed through various platforms, including over-the-counter (OTC) markets, centralized exchanges, or specialized dealer networks. The quotation of the metal is constantly influenced by global economic shifts, monetary policy changes, and supply-demand dynamics within the jewelry, industrial, and financial sectors.

Six Common Gold Placements

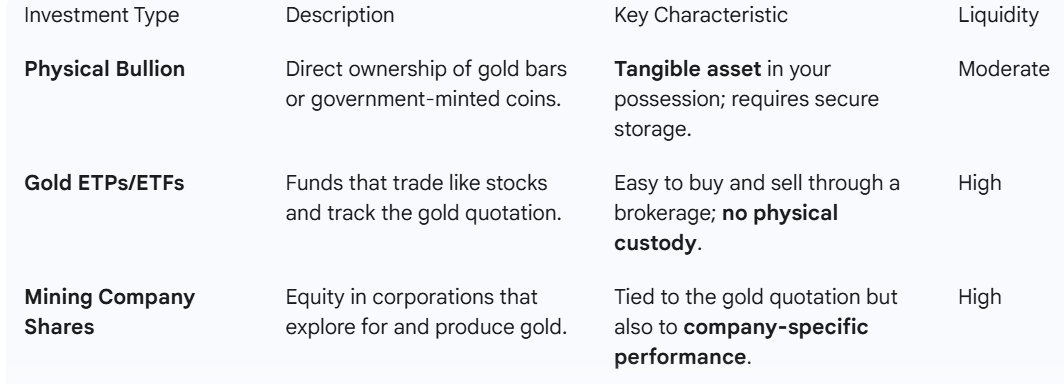

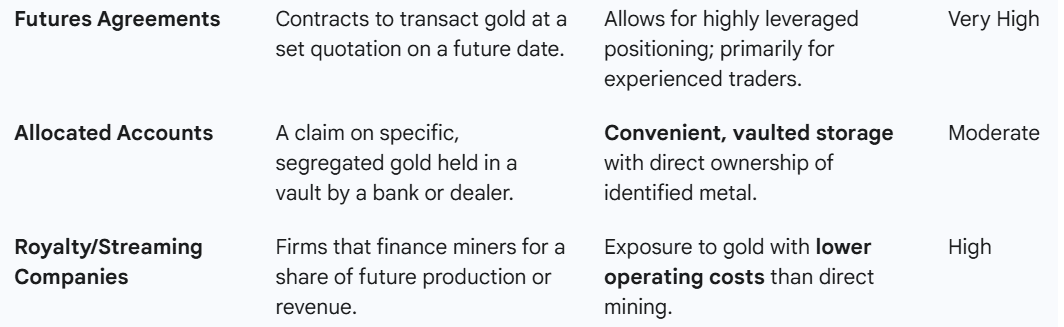

The realm of gold placement offers several distinct pathways for acquiring exposure to the metal's market movements and intrinsic value:

Physical Bullion: This involves the direct ownership and possession of the physical commodity in the form of bars, wafers, or minted coins. This placement is valued for its tangibility and removal from counterparty risk associated with financial institutions.

Exchange-Traded Products (ETPs): These are financial securities that track the quotation of gold and trade on stock exchanges, much like shares of a company. They allow participants to gain exposure to the metal's quotation movement without the need to store or insure the physical commodity themselves.

Mining Company Shares: Instead of holding the metal itself, one can purchase equity in corporations that specialize in the exploration, extraction, and refinement of gold. The performance of these shares is tied not only to the gold quotation but also to the operational efficiency and management of the company.

Futures Agreements: These are standardized, legally binding contracts traded on an exchange that obligate the purchaser to buy or the seller to sell a specified amount of gold at a predetermined quotation on a certain date in the future. They are primarily used for managing risk and speculation.

Allocated Accounts: A financial service offered by some depositories or banks where the holder owns specific, identifiable gold bars or coins. The physical metal is segregated and legally belongs to the account holder.

Unallocated Accounts: A more common service where the holder possesses a general claim against a depository for a certain weight of gold, but the metal is not segregated or tied to specific, identifiable bars. This represents a balance on the depository's ledger.

Six Strategies to Trade Gold

Dealing in the gold market can be approached using several methodologies, each focusing on different market signals:

Fundamental Positioning: This methodology centers on examining global economic data, macroeconomic trends, and major political events. The participant forms a view on the metal's future quotation by assessing central bank monetary policies, global currency fluctuations, and worldwide industrial demand.

Contrarian Placement: This approach involves taking a position opposite to the prevailing market sentiment. When the majority of participants are heavily oriented one way (either buying or selling), a contrarian may assume that the prevailing mood is overly extended and due for a reversal in the metal’s quotation direction.

Trend Following: This method involves the observation and identification of a market’s established direction of movement. Once a strong uptrend or downtrend in the metal’s quotation is confirmed, the participant aligns their placement to move with that flow, holding the position until the trend shows clear signs of reversal or exhaustion.

Arbitrage: This involves exploiting temporary discrepancies in the gold quotation across different markets or forms. For example, buying a gold-linked ETP in one location and simultaneously selling a futures agreement in another if a momentary, non-economic quotation imbalance exists.

Hedging with Derivatives: Participants use instruments like futures or options agreements to mitigate the risk exposure in their existing holdings. A gold producer, for instance, may sell futures to lock in a quotation for their future output, protecting them from a potential price drop.

Intermarket Relation: This strategy focuses on the historical correlation between gold and other major assets, such as specific global currencies or various commodities. Participants take a position in gold based on the movements of a related market, anticipating that the established relationship will continue to hold true.

Main Factors Influencing the Gold Price

The market quotation for gold is a highly dynamic figure, subject to influence from a constellation of global economic and geopolitical forces:

Monetary Policy and Real Rates: The policies enacted by major central banks have a profound impact. Specifically, the level of real interest rates—the return on fixed assets after accounting for expected inflation—is a critical driver. When real rates are low, the cost of holding a non-yielding asset like gold becomes comparatively small, affecting its market status.

Currency Strength: Gold is predominantly denominated in the world's chief reserve currency. Consequently, when this currency weakens on the international stage, it takes more units of that currency to acquire the same amount of gold, generally leading to a higher quotation. Conversely, a strengthening currency often exerts downward pressure.

Inflation Expectations: When market participants anticipate a general erosion of purchasing power in paper money, demand for the metal often shifts upward. Gold is frequently viewed as a reliable store of value that preserves wealth during periods of rising consumer quotations.

Geopolitical and Political Instability: Periods marked by international conflict, political upheaval, or uncertainty tend to boost the metal’s quotation. In such times, global holders of wealth often rotate funds into assets perceived as having enduring value outside of any single nation's economy or banking system.

Supply and Demand Dynamics: The physical flow of the metal plays a constant role. This includes the volume of new gold extracted from mines, the amount of recycled gold entering the market, and the total global demand from industrial uses and jewelry fabrication.

Central Bank Activity: The actions of monetary authorities, particularly in emerging nations, are highly influential. Large-scale buying or selling of gold for their national reserves can directly impact available supply and send powerful signals to the wider market about the metal's role as a primary reserve asset.

Summary

Dealing in gold is a multilayered financial pursuit that spans across tangible bars and complex financial agreements. It is fundamentally driven by a participant's belief about the future direction of its market quotation. Placements range from direct physical custody and segregated depository accounts to holding shares in mining corporations or trading sophisticated instruments like futures and exchange-traded products.

To navigate this market, various approaches are utilized. Some participants focus on the fundamental positioning, assessing broad economic conditions and central bank actions, while others employ trend following to align with the market's current momentum. Still others may engage in hedging to offset potential portfolio risks or use contrarian placement to bet against overly uniform market mood.

Looking to trade Gold CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.