You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

புதன் Aug 20 2025 11:49

4 நிமி

The Reserve Bank of New Zealand (RBNZ) cut its policy rate by 25 basis points to a three-year low of 3.00% on Wednesday, signalling further easing ahead as growth faces both domestic and global pressures. The central bank also lowered its projected cash rate floor to 2.55%, compared with 2.85% in May, with two of the six policy committee members even pushing for a deeper 50-basis-point cut.

Governor Christian Hawkesby stressed that the outlook remains data-dependent, but said more action may be needed if businesses and consumers stay cautious. Since August 2024, the RBNZ has reduced rates by a cumulative 250 basis points to support a fragile recovery. Still, officials noted that consumption and investment demand weakened in Q2 2025, partly due to uncertainty from the U.S. tariff policy shakeup in April.

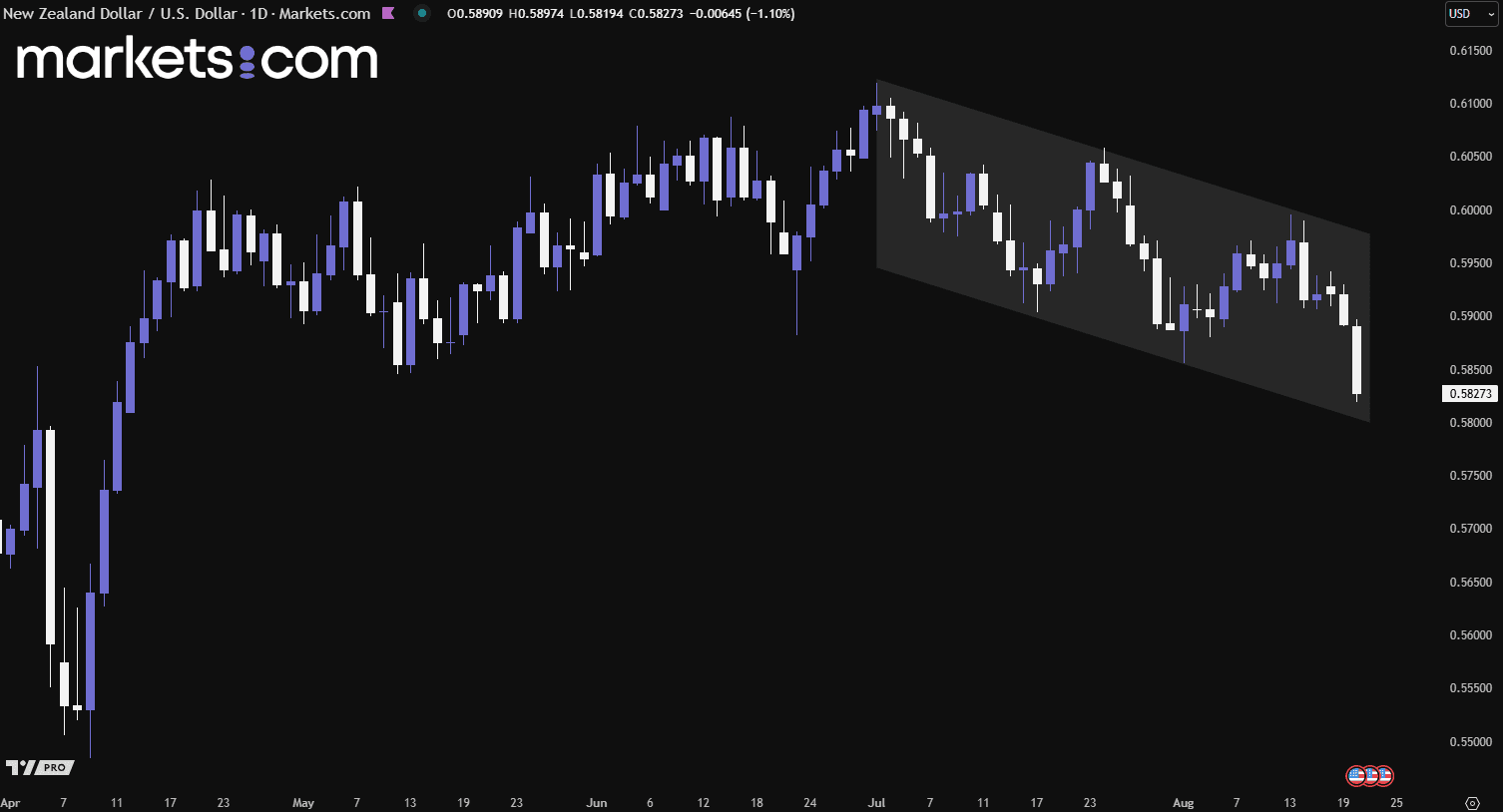

(NZD/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the NZD/USD currency pair has been in a bearish trend since early July 2025, as shown by the formation of lower highs and lower lows within a descending channel. The pair continues to move lower with strong bearish momentum and may retest the channel’s lower boundary. A decisive break below this level with substantial bearish momentum could signal an overall trend shift to the downside, potentially driving the pair even lower.

UK inflation accelerated to 3.8% in July, the fastest pace in 18 months and above forecasts of 3.7%, further weakening expectations for near-term rate cuts by the Bank of England. The rise followed June’s 3.6% reading, according to the Office for National Statistics. Services inflation, closely watched by the BoE, also increased to 5.0% from 4.7%.

Earlier this month, the BoE cut its benchmark rate by 25 basis points to 4.0% in a split decision, even as it raised its inflation outlook. Policymakers warned that higher food and energy costs could push inflation expectations higher. The Bank now projects inflation will peak at 4% in September, double its 2% target. Having cut rates five times since last summer, the BoE is expected to slow the pace of easing as price pressures persist.

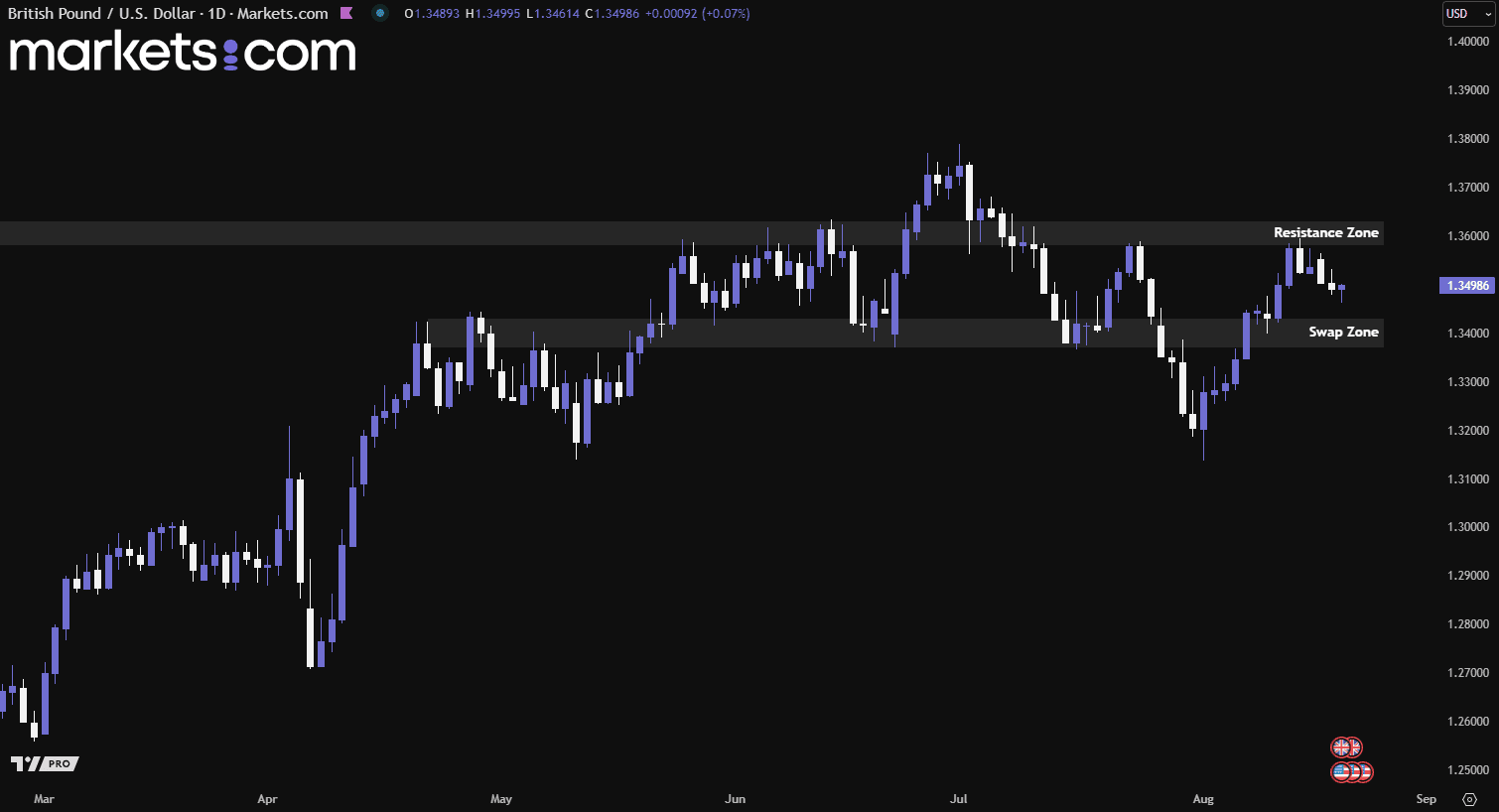

(GBP/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the GBP/USD currency pair was recently rejected from the resistance zone of 1.3580 – 1.3630, pushing the pair lower and bringing it closer to the swap zone of 1.3370 – 1.3430. The ongoing bearish momentum could drive the pair to retest this zone. If the swap zone provides support, the pair may potentially resume an upward move. Conversely, a decisive break below this level with strong bearish momentum could lead to further downside.

Tesla announced on China’s Weibo platform that the Model Y L is “coming soon.” The new model, a six-seat version of its best-selling Model Y with an extended wheelbase, was showcased in a promotional video. The launch reflects Tesla’s efforts to refresh its lineup amid intensifying competition, particularly from Xiaomi’s newly released YU7.

The move comes as Tesla faces headwinds in China, where July sales of its locally produced EVs dropped 8.4% amid an ongoing price war that is pressuring automakers, suppliers, and dealerships. Alongside the Model Y L, Tesla is also preparing to introduce a longer-range, rear-wheel-drive Model 3 in China, according to filings with the country’s industry ministry in July.

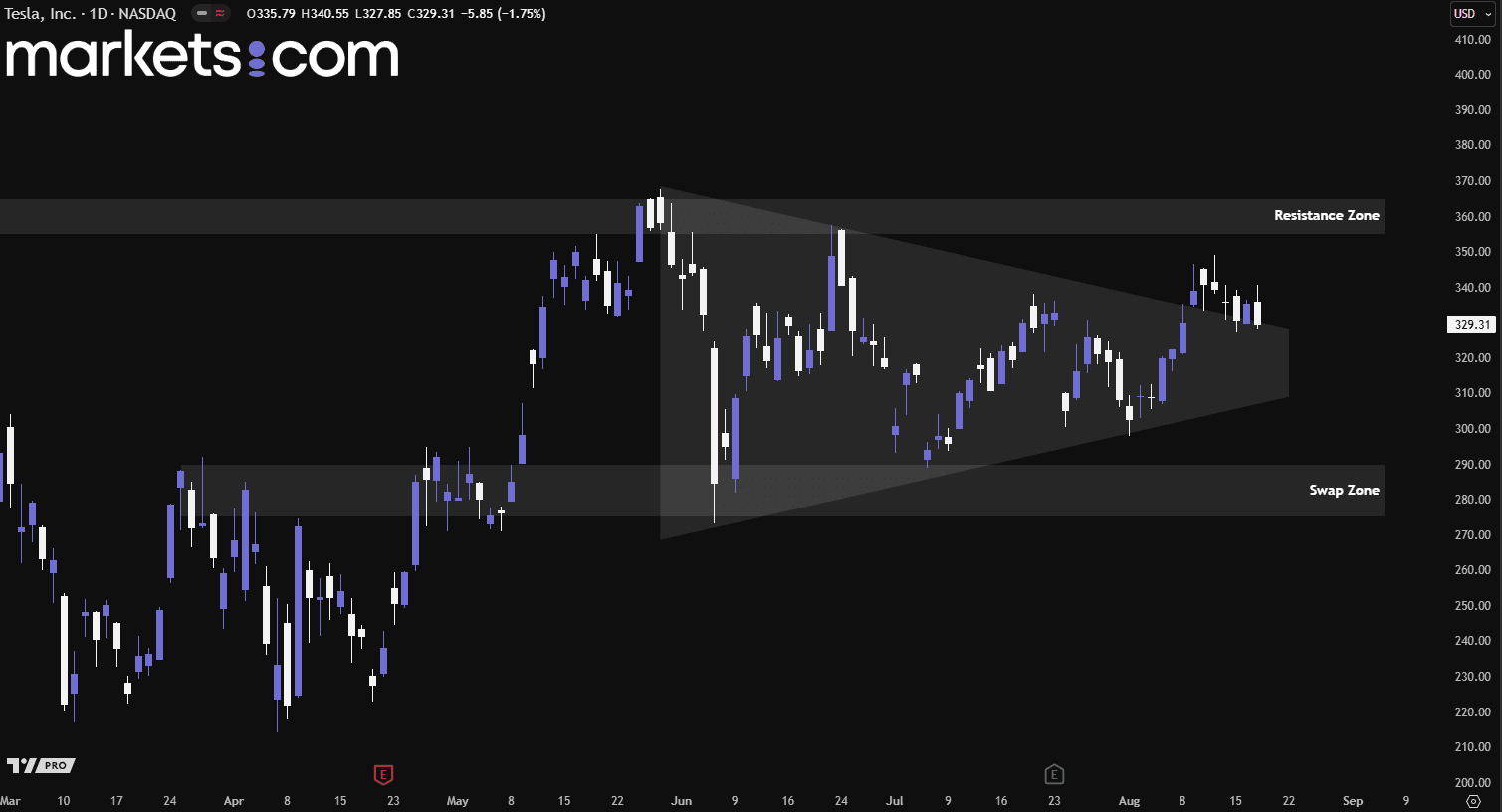

(Tesla Daily Share Price Chart, Source: Trading View)

From a technical analysis perspective, the Tesla share price broke above the symmetrical triangle recently, indicating that bullish forces have prevailed over bearish forces in this battle. This could potentially push the price higher to retest the resistance zone of 355 – 365. If it can break above this zone, further upside movement is likely.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.